As a small business owner, you're juggling a dozen tasks at once. Among all the numbers you track, retention rate and churn rate are two of the most critical. They're two sides of the same customer loyalty coin, telling you everything you need to know about your business's health.

Think of it this way: your retention rate is the percentage of customers you successfully keep. It's a direct measure of customer satisfaction and the value you provide. On the flip side, your churn rate is the percentage of customers you lose, acting as an early warning system for problems you need to fix-fast.

Two Sides of the Same Customer Loyalty Coin

Whether you run a bustling café, a popular salon, or a neighborhood restaurant, understanding retention and churn is the key to sustainable growth. These metrics offer a powerful, at-a-glance snapshot of your business health. They don't just tell you how many customers you have, but how happy and loyal they are.

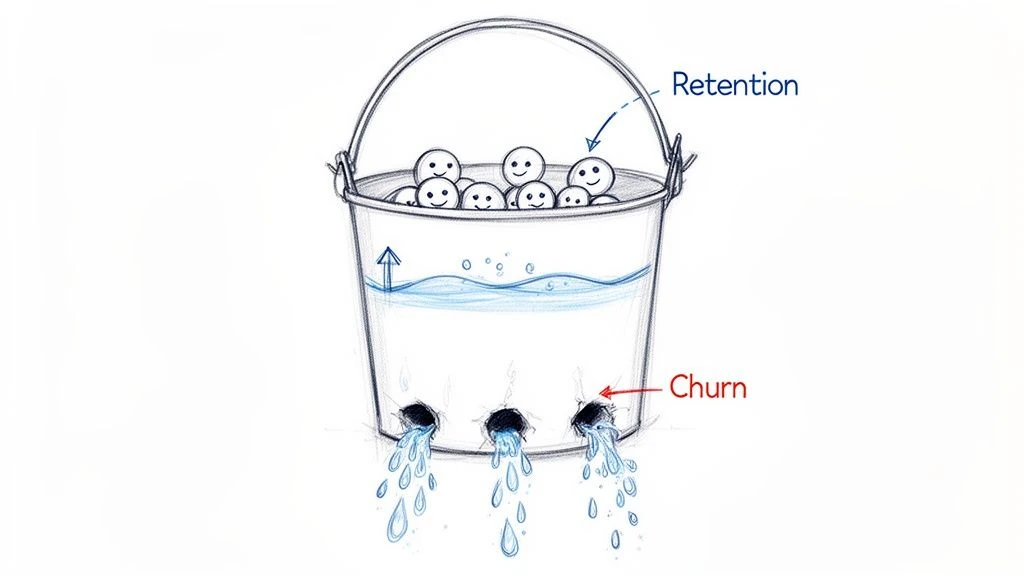

The leaky bucket analogy is perfect. Retention is about keeping your customer bucket full and overflowing. Churn represents the leaks you must plug to stop your profits from draining away.

The two rates are inversely related, which makes them simple to understand together. If your retention rate for the month is 80%, your churn rate is automatically 20%. While they measure opposite outcomes, they tell a single, crucial story about your customer experience.

What Is Customer Retention Rate?

Customer Retention Rate (CRR) measures the percentage of existing customers who continue to do business with you over a specific period. A high retention rate is fantastic news-it’s a strong signal that your customers are happy, loyal, and see real value in what you offer. This is the metric that proves you’re doing things right.

What Is Customer Churn Rate?

Customer Churn Rate, on the other hand, is the percentage of customers who stop doing business with you during that same period. This is your business’s early warning system. A rising churn rate can flag issues with your service, product quality, or pricing that need your immediate attention before they spiral.

Retention vs Churn Quick Comparison

This table gives you a fast, at-a-glance understanding of what each metric reveals about your business and where your focus should be.

| Metric Focus | Retention Rate | Churn Rate |

|---|---|---|

| What It Measures | The percentage of customers you keep. | The percentage of customers you lose. |

| What It Indicates | Customer satisfaction, loyalty, and brand health. | Customer dissatisfaction, service issues, or competitive threats. |

| Business Goal | Maximize this number to grow customer lifetime value. | Minimize this number to prevent revenue loss. |

| Analogy | Keeping water in the bucket. | The size of the leaks in the bucket. |

While they seem simple, the story these numbers tell is profound. They help you shift from just acquiring new customers to truly understanding and serving the ones you already have.

Picture this: your loyalty program isn't just a fun perk-it's a profit protector. Across most industries, the average customer retention rate is about 75%, which means an average churn rate of 25% that could be costing you big time. For restaurant and salon owners using a tool like BonusQR, this stat really hits home. It’s why focusing on retention almost always beats chasing new faces.

Your repeat customers-often just a small group of regulars-are your most valuable asset. That vital 20% of loyal customers can generate up to 80% of your future profits. They also tend to spend 67% more than new customers and 31% more per visit. If you want to dive deeper, you can find more customer retention statistics that highlight just how powerful a good loyalty program can be.

Figuring Out Your Retention and Churn Rates

Knowing the difference between retention and churn is one thing, but the real magic happens when you start calculating these numbers for your own business. Don't worry, you don't need to be a data scientist. These formulas are straightforward and designed for busy owners like you.

Running these simple calculations gives you a clear, honest snapshot of customer loyalty. When you track them regularly-say, every month or quarter-you start to see trends emerge, giving you a chance to act before a small dip becomes a major problem.

How to Calculate Your Customer Retention Rate

Your Customer Retention Rate (CRR) tells you what percentage of your customers stuck around over a certain period. It's laser-focused on the loyal base you already had.

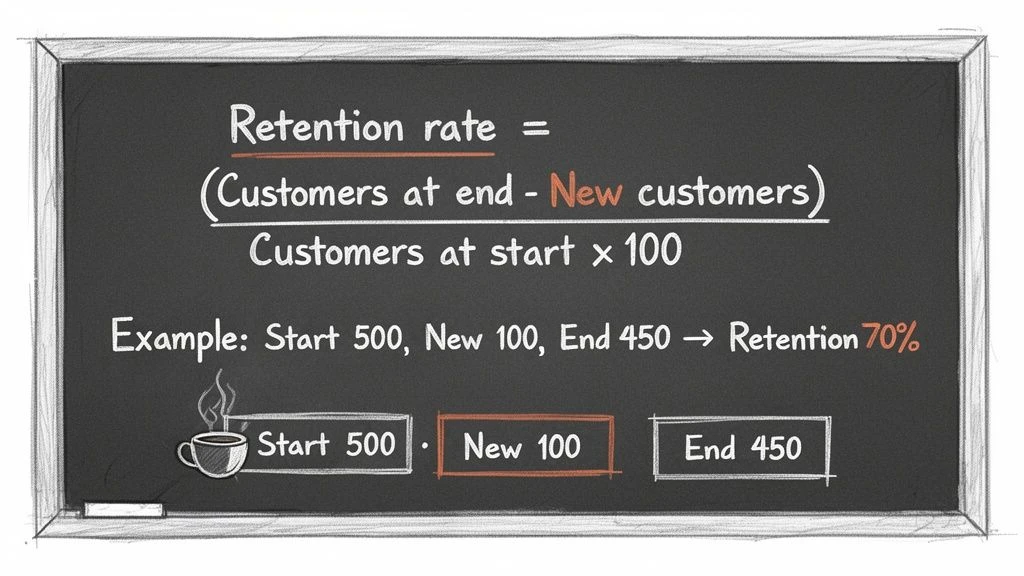

Here’s the formula:

CRR = [ (Customers at End of Period - New Customers Acquired) / Customers at Start of Period ] x 100

Let’s quickly break that down:

- Customers at Start of Period: The total number of customers you had on day one.

- Customers at End of Period: The total number of customers you had on the very last day.

- New Customers Acquired: Every brand-new face that came in during that time.

Subtracting new customers is crucial. It ensures you're measuring the loyalty of the people you started with, giving you a true read on their satisfaction. If you want to get even more granular, you can learn more about how to calculate customer retention rate and apply it to your specific business.

How to Calculate Your Customer Churn Rate

Your Customer Churn Rate is simply the flip side of retention. It measures the percentage of customers who walked away during that same period. Think of it as a direct measure of customer loss.

The simplest way to figure it out is:

Churn Rate = (Customers Lost / Customers at Start of Period) x 100

But if you’ve already got your retention rate handy, there’s an even easier way:

Churn Rate = 100% - Retention Rate

The simplicity here is powerful. It means every single thing you do to boost retention directly knocks down your churn rate. They're two sides of the same coin.

A Real-World Example: A Local Cafe

Let’s put these formulas to work with a scenario that any small business owner will recognize. Imagine you own a local coffee shop and want to figure out your retention and churn for the month of April.

Here are your numbers:

- You started April with 500 customers.

- You ended the month with 450 total customers.

- You brought in 100 new customers during April.

First, let's find that retention rate:

- Customers at End (450) - New Customers (100) = 350

- 350 / Customers at Start (500) = 0.70

- 0.70 x 100 = 70%

Your customer retention rate for April was 70%. That means you held on to 70% of your original customer base.

Now, let's get your churn rate:

- Churn Rate = 100% - 70% (Retention Rate) = 30%

Your churn rate was 30%, which means you lost almost a third of your initial customers that month. Suddenly, these two numbers paint a very clear picture of where you need to focus your energy.

Why Both Metrics Are Critical for Business Health

Beyond the formulas, your retention and churn rates tell a story about your business’s future. Think of them as your offense and defense. Your retention rate is your offense-it shows how well you’re creating happy, loyal customers who want to stick around. It’s a powerful sign of what you're doing right.

On the flip side, your churn rate is your defense. It’s a diagnostic tool that flags problems before they get out of hand. A sudden jump in churn can point to issues with service, pricing, or something in your day-to-day operations you might otherwise miss.

Offense and Defense for Your Business

A high retention rate gives you a stable foundation to build on. Loyal customers don't just spend more; they become your biggest fans, spreading the word and bringing in new business for free. This frees you up to invest in things that actually move the needle, like training your staff or upgrading your services.

A high churn rate, however, traps you in a costly cycle of constantly trying to find new customers. Instead of investing in growth, all your energy goes into running ads just to replace the people you're losing. It makes long-term stability feel like a distant dream.

A salon with high retention invests in advanced training for its stylists, delighting clients who eagerly rebook. A salon with high churn is stuck running a perpetual "20% Off for New Clients" ad, hoping to fill empty chairs left by dissatisfied customers.

This difference in focus has a huge financial impact. While retention and churn directly affect your customer lifetime value, getting a handle on and mastering Cost Per Acquisition (CPA) is just as crucial for a healthy bottom line.

Pinpointing Problems Before They Hurt Your Bottom Line

Imagine you run a cozy coffee shop. The morning rush brings in plenty of new faces, but you start to notice that your regulars are slowly disappearing. This is a tough reality in the hospitality, travel, and restaurant sector, which has the lowest customer retention rate worldwide at just 55%-a shocking 20% drop from previous years. For a small business owner, that means for every 100 customers who walk in, only 55 come back. That leaves a massive 45% churn rate eating away at your profits.

Tracking both metrics helps you spot these leaks and figure out why they’re happening.

- Did churn spike after a price increase? Your pricing might be out of sync with the value you’re offering.

- Do you lose customers after their first or second visit? Your initial experience might not be living up to expectations.

- Is retention highest with one specific employee? You've found a star performer whose approach can be a model for your whole team.

By looking at retention and churn together, you can stop guessing and start knowing. This data-driven approach lets you make precise, effective changes that keep customers from walking away. For a deeper dive, check out our guide on how to reduce customer churn and keep your best customers.

Ultimately, these numbers empower you to build a more resilient and profitable business, turning casual visitors into a community of loyal fans who choose you every time.

When to Prioritize Retention or Churn

Knowing the difference between retention and churn is one thing, but figuring out which one deserves your attention right now is the real challenge. Both are vital, but where you are in your business journey should decide what you focus on. Making the right choice means putting your limited time and money where they’ll make the biggest impact.

For a brand-new café, for instance, a high churn rate in the first few months is a massive red flag. Forget about lifetime value for a moment; this is about survival. You have to get obsessive about cutting that early churn. It’s the only way to find and fix the core problems with your coffee, your service, or the vibe before those issues poison your reputation for good.

On the flip side, an established restaurant with a steady stream of regulars should be thinking differently. Their focus should shift to systematically increasing the retention rate. With the day-to-day operations humming along, the goal is to boost profitability by encouraging loyal customers to visit more often and spend a little more when they do.

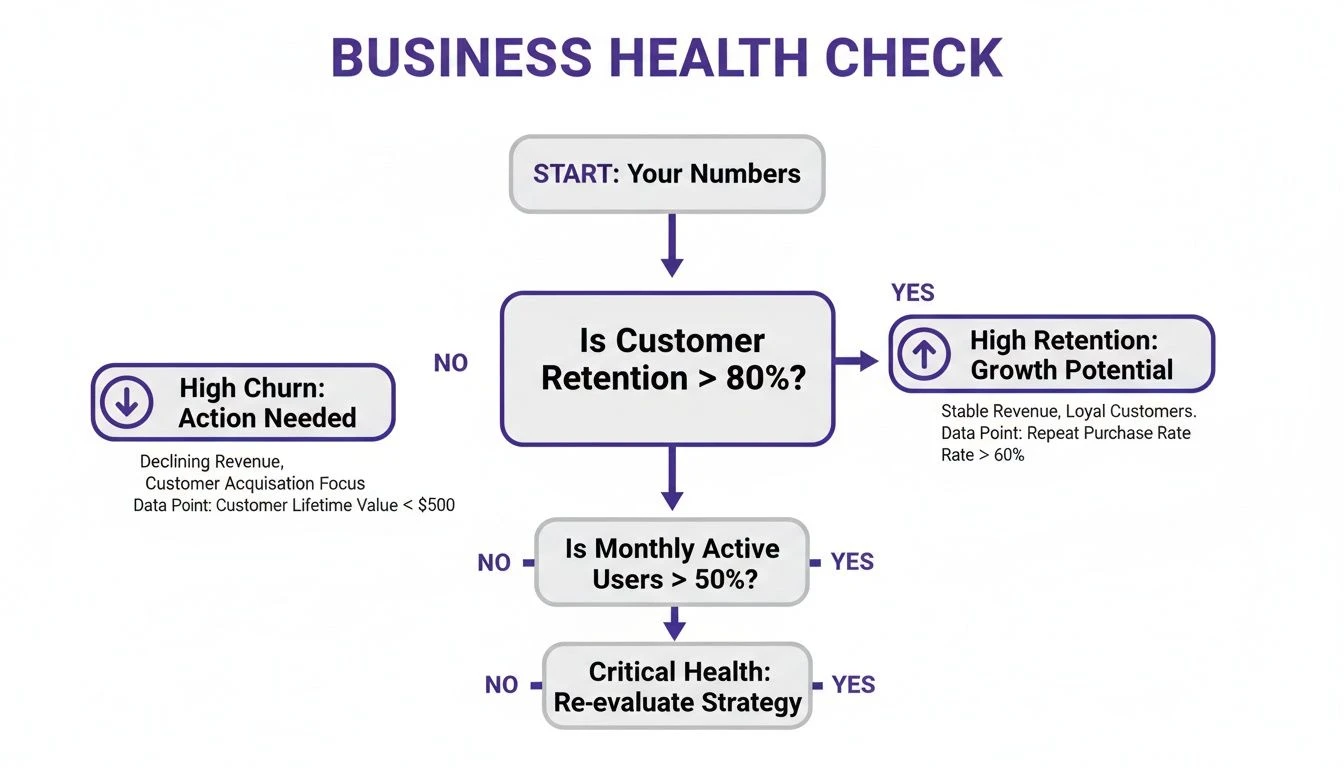

Diagnosing Your Business Health

Let the numbers guide you. A sudden drop in repeat customers is a signal to play defense. You need to plug that leak by figuring out why people are leaving. But if your customer base feels stable and healthy, it's time to go on the offensive and build deeper loyalty with retention-focused moves.

This simple decision tree can help you do a quick health check based on your current numbers.

As the flowchart shows, high retention can sometimes hide underlying churn problems. That’s why you have to look at both metrics to get the full picture of customer loyalty.

Situational Priorities: A Practical Guide

Your strategy can't be set in stone. Don’t just pick one metric and stick with it forever. The smartest business owners adapt their focus based on what the business is telling them in real-time. Here’s a quick guide on when to lean one way or the other.

Focus on Reducing Churn Rate If:

- You've just launched. Your main goal is getting to product-market fit. If customers are trying you once and never coming back, your offering isn't hitting the mark.

- You see a sudden spike in lost customers. This is an all-hands-on-deck situation. You need to figure out what happened-was it a price hike, a new competitor opening down the street, or a dip in service quality?

- Negative feedback is on the rise. Bad online reviews, angry social media comments, and direct complaints are the early warning signs of churn.

Focus on Increasing Retention Rate If:

- Your business is stable and running smoothly. Once you have a steady customer base and consistent operations, it’s time to nurture those relationships for long-term growth.

- You want to boost customer lifetime value (CLV). Retention is where the real profit is. Getting an existing customer to come back is always cheaper than finding a new one.

- Your market is saturated. When new customers are tough to find, your best bet for growth comes from the people who already know and like you.

For a small business, this isn't about choosing one metric to rule them all. It's about knowing which lever to pull right now. An unexpected jump in churn demands an immediate defensive move. A period of stability, on the other hand, is your green light to build offensive momentum with retention.

Ultimately, balancing these two is key. A simple, affordable loyalty program like BonusQR can actually do both. It helps you re-engage customers who might be about to churn while also rewarding your regulars to keep them coming back-all from one platform.

How a Loyalty Program Impacts Retention and Churn

Okay, so you understand the difference between retention rate vs churn rate. That's the first step. But the real question is always, what can I actually do about it?

For a busy small business owner, the answer has to be simple, affordable, and effective. This is where a digital loyalty program becomes your secret weapon.

Instead of just crossing your fingers and hoping customers come back, a loyalty program gives them a solid, compelling reason to choose you over the competitor down the street. It’s a direct fix for the root causes of both high churn and low retention, turning those abstract numbers into real, tangible growth.

Boosting Your Retention Rate with Simple Rewards

A high retention rate is built on repeat visits. A loyalty program is designed to do just that, turning a casual, one-time visitor into a regular who feels genuinely valued.

Think of it as a positive feedback loop:

- A customer has a great experience.

- They get an easy-to-use digital stamp card via a simple QR code scan.

- They immediately have a reason to return to earn their next stamp.

This small act of recognition makes people feel appreciated, which is a huge driver of loyalty. In fact, customers are 2.7 times more likely to stick with a brand that offers a loyalty program.

For a small café, this is the difference between someone who grabs a coffee once and a regular who stops by three times a week, eagerly getting closer to their free drink. A program like BonusQR makes this process completely seamless.

Reducing Churn by Catching At-Risk Customers

While boosting retention is your offense, a loyalty program is also your best defense against churn. One of the biggest headaches for any small business is not knowing when a customer is about to disappear for good. They just… stop showing up.

A digital loyalty program gives you visibility. You can see who your regulars are and, more importantly, who has stopped visiting. This is your golden opportunity to be proactive before they become just another churn statistic.

For example, with a platform like BonusQR, you can easily spot customers who haven't checked in for 30 or 60 days. Instead of losing them forever, you can launch a quick, targeted re-engagement campaign with a simple, personalized message:

- "We miss you! Here's a free pastry on your next visit."

- "It's been a while. Come back this week and get double stamps."

This small gesture is incredibly powerful. It reminds them why they liked you in the first place and shows them that you actually notice when they're gone. It’s a targeted, low-cost way to patch the leaks in your customer bucket.

Impact of a Loyalty Program on Business Challenges

Implementing a loyalty program creates a clear "before and after" for your business. It's a strategic tool that directly solves the common pain points driving up churn and holding back retention.

This table clearly illustrates the direct, positive effects that implementing a simple loyalty solution like BonusQR can have on the metrics that matter most to a small business.

| Business Challenge | Without Loyalty Program | With BonusQR Loyalty Program |

|---|---|---|

| Customer Visits | One-time visits are common, with no real incentive for a customer to return. | Customers are motivated to come back to earn rewards, naturally increasing their visit frequency. |

| Customer Data | You're flying blind, with no idea who your regulars are or when they last visited. | You can easily track visit history and identify both loyal regulars and at-risk customers. |

| Re-Engagement | Lost customers are just gone. There's no practical way to reach out and win them back. | You can send targeted offers to lapsed customers, giving you a chance to win them back before they churn for good. |

| Customer Connection | The relationship is purely transactional and easily forgotten once they walk out the door. | Customers feel valued and appreciated, which helps build a genuine, emotional connection to your brand. |

Ultimately, a loyalty program bridges the gap between understanding the retention rate vs churn rate and actively improving them. It's the engine that not only rewards your best customers but also helps you save the ones you’re about to lose.

Your Action Plan for Better Customer Loyalty

Understanding the difference between retention vs churn rate is a great first step. But real magic happens when you move from theory to action. This is how you’ll see tangible results in your business.

Let's walk through a simple, five-step plan that turns your new knowledge into a powerful strategy for growth.

Your Five Step Loyalty Roadmap

This process isn't about getting bogged down in complex analytics. It’s about taking small, focused steps that lead to big improvements in how you keep customers coming back.

Calculate Your Baseline: Before you can improve, you have to know where you stand. Use the simple formulas we covered to figure out your current retention and churn rates for the last month or quarter. This is your starting point-your benchmark for success.

Set a Realistic Goal: Don't aim to cut churn in half overnight. A small, achievable goal is far more effective. For instance, try to increase your retention rate by 5% over the next quarter. This makes your progress measurable and keeps you and your team motivated.

Pinpoint the "Why": The numbers tell you what is happening, but you need to uncover why. Get on the ground and talk to your frontline staff-what are the most common complaints they hear? If a customer leaves, ask for some honest feedback. Your goal is to identify one main reason for churn, whether it's slow service, inconsistent quality, or a competitor's shiny new offer.

Don’t try to solve every problem at once. Focusing on the single biggest reason customers leave allows you to direct all your energy toward a fix that will have the most significant impact on your numbers.

Implement a Simple Solution: Now, it's time to address that one problem head-on. If customers feel unappreciated, a loyalty program is a perfect fix. It gives them an immediate, tangible reason to return and feel valued. This is where a tool like BonusQR becomes a game-changer-it’s a cost-effective, simple way to make every customer feel like a VIP without adding complexity to your day.

Track and Adjust: Loyalty isn't a "set it and forget it" task. Check your retention and churn numbers weekly or bi-weekly. Are you moving closer to that 5% goal? If not, it’s time to make small adjustments. Maybe your rewards aren't compelling enough, or perhaps you need to promote the program more actively at checkout.

Of course, a loyalty program is just one piece of the puzzle. For small businesses looking to improve their customer loyalty and bottom line, implementing sound digital marketing strategies is also essential. You can explore some actionable digital marketing strategies for small businesses to help round out your efforts.

This straightforward plan turns abstract metrics into a practical tool for growth. By following these steps, you’re not just tracking numbers-you’re actively building a business that customers genuinely love.

Ready to Turn Churn into Retention?

Understanding the numbers is the first step. Taking action is what builds a thriving business. A simple, effective loyalty program is the most direct way to boost your retention rate and cut your churn rate simultaneously.

With BonusQR, you can launch a digital loyalty program in minutes-no clunky hardware, no complicated software, and no training required for your staff. It’s the simplest, most affordable way to:

- Increase repeat visits by giving customers a reason to come back.

- Identify and win back at-risk customers before they're gone for good.

- Build a community of loyal fans who choose you every time.

Stop letting your best customers slip away. Start your free trial of BonusQR today and see how easy it is to build a more loyal, profitable business.

Got Questions? We’ve Got Answers.

When you’re digging into metrics like retention and churn, a few questions always pop up. Here’s a quick rundown of what small business owners usually ask, with straightforward answers to help you get it right.

What’s a Good Retention Rate for My Business?

There’s no magic number here, because “good” really depends on your industry. If you run a local service business like a salon or a café, shooting for a monthly retention rate of 80% or higher is a solid goal. That means you’re successfully keeping at least 8 out of every 10 customers coming back, which creates a healthy foundation for growth.

But for businesses like restaurants, where people love to try new places, the numbers might naturally be lower. The most important thing is to figure out your own baseline first. Once you know where you stand, you can focus on making small, steady improvements every quarter.

Should I Focus on New Customers or Keeping Old Ones?

For most small businesses, the answer is a no-brainer: focus on retention first. Chasing down a new customer can cost you five times more than keeping an existing one. Plus, your regulars are the ones who spend more over time and become your best brand ambassadors through word-of-mouth.

Of course, you always need a stream of new faces walking through the door. But your long-term health and profitability come from turning those first-timers into loyal fans.

A business that only chases new customers is like a bucket with a hole in it-you have to keep pouring in more water just to stay afloat. A business focused on retention plugs the hole, making every drop you add go further.

How Often Should I Calculate These Metrics?

For most small businesses, calculating your retention and churn rates monthly is the sweet spot. It gives you enough data to spot real trends without getting lost in the noise of daily ups and downs. A monthly check-in is perfect for seeing if that new menu item, price change, or loyalty program launch is actually making a difference.

If your business is highly seasonal or you’re running a big promotion, you might want to check in every couple of weeks during that period just to keep a closer eye on things.

Can a Simple Loyalty Program Really Make a Difference?

Absolutely. A loyalty program is one of the most direct and affordable ways to move the needle on both retention and churn. It gives customers a clear, tangible reason to choose you again, which is a straight shot to boosting your retention rate.

At the same time, it helps you spot customers who are at risk of churning-the ones who haven't visited in a while. This gives you a chance to send them a friendly nudge or a special offer to bring them back before they're gone for good. For a small business, a simple digital tool like BonusQR can be the perfect way to start building that loyal community and protecting your bottom line.