It’s a feeling every restaurant owner knows: the dining room is packed, but your bank account tells a much leaner story. This gap between looking busy and being profitable is why you have to master your numbers. A good restaurant profit margin calculator is your starting point-it's the tool that finally reveals where your hard-earned money is really going.

This guide will give you more than just formulas. We'll provide actionable advice to plug hidden profit leaks and position your restaurant for sustainable growth, showing how simple tools can make a massive difference.

Why Your Profits Feel Lower Than Your Sales

That frustrating disconnect between high sales and low profits almost always comes down to one thing: confusing gross profit margin with net profit margin.

Think of them as two different chapters in your financial story. One tells you how much you make from your menu. The other reveals what you actually keep after every single bill is paid.

For a typical full-service restaurant, gross margins on food might look fantastic, somewhere in the 65-75% range. But after you've paid for rent, labor, and utilities, the net profit margin often lands between a razor-thin 3-5%. This means for every $100 that comes in, you’re only pocketing $3 to $5.

Gross Margin vs. Net Margin at a Glance

To truly understand your restaurant’s financial health, you need to see these two key metrics side-by-side. Here’s a quick breakdown of what each one tells you.

| Metric | What It Measures | Why It Matters to You |

|---|---|---|

| Gross Profit Margin | The profitability of your menu items alone, before any other expenses. | This tells you if your food costing and menu pricing are on track. A healthy gross margin is your first line of defense. |

| Net Profit Margin | Your final profit after all business expenses are paid, from rent to wages. | This is your true bottom line-the number that shows if your business model is sustainable. It’s what you actually take home. |

Seeing both numbers clearly shows you where the money is going and helps you focus not just on sales volume, but on making every sale as profitable as possible.

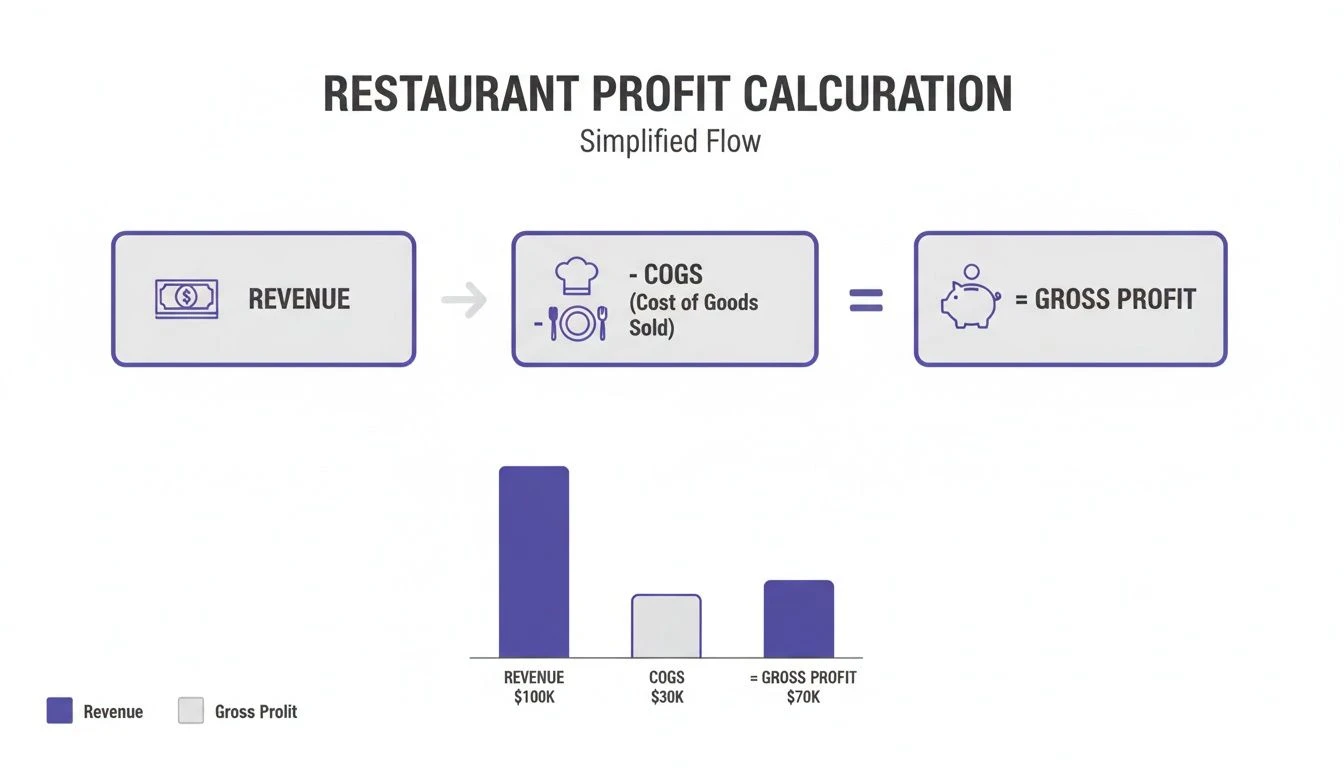

Gross Profit: Your Menu's Story

Your gross profit margin is a direct look at how profitable your menu is. You calculate it by taking your total revenue and subtracting only the Cost of Goods Sold (COGS)-the direct cost of your ingredients and beverages.

This number answers a critical question: "Are my prices high enough to cover my ingredients?" A healthy gross margin means your core product is making money.

Net Profit: Your Business's Reality

Your net profit margin is the real bottom line. It’s what’s left after all your expenses have been deducted from revenue. This goes beyond food costs and includes:

- Labor Costs: Wages, salaries, payroll taxes, and benefits.

- Operating Expenses: Rent, utilities, insurance, marketing, and linen services.

- Administrative Costs: POS system fees, accounting services, and software charges.

This is the number that reveals if your business can survive long-term. To get a clear picture, using a dedicated restaurant profit margin calculator isn't just helpful-it's essential.

A high gross margin might make you feel successful, but it's the net margin that pays the bills. Ignoring it is like celebrating winning a battle while losing the war.

Understanding this difference is the 'aha' moment for many operators. It pinpoints where revenue is being eaten up and shifts your focus from just making sales to making profitable sales. As we'll cover, driving repeat business is one of the smartest ways to protect that fragile net margin. You can learn more by reading our article on how loyalty programs drive profitable sales growth.

How to Calculate Your Restaurant Profit Margin

You don't need an accounting degree to get a grip on your finances. Let's walk through a practical, jargon-free guide to calculating both your gross and net profit margins using simple formulas.

The Two Formulas You Need to Know

First is your Gross Profit Margin. This measures your menu's profitability before any other expenses are factored in.

- Gross Profit Margin Formula: (Total Revenue - COGS) / Total Revenue

Next is the big one: your Net Profit Margin. This is your true bottom line, showing what percentage of revenue you keep after all bills are paid.

- Net Profit Margin Formula: (Total Revenue - All Expenses) / Total Revenue

These formulas are simple, but their power comes from using accurate numbers. Let's break down where to find them.

Finding the Right Numbers

A calculation is only as good as its data. To get a true picture, you need to pull information from a few key sources:

- Total Revenue: This is the easiest. Your Point of Sale (POS) system is your source of truth. Pull a sales report for the period you want to measure.

- Cost of Goods Sold (COGS): This is the direct cost of ingredients for what you sold. You'll need supplier invoices and inventory counts to calculate this accurately.

- All Expenses: This is everything else. Gather your payroll reports for labor costs and check your accounting software for operating expenses like rent, utilities, and marketing fees.

Now, let's put these formulas to work with real-world examples.

Example 1: The Independent Pizzeria

Imagine you run a classic neighborhood pizzeria focused on efficiency and cost control. Here are your numbers for a typical month.

- Monthly Revenue: $55,000

- Cost of Goods Sold (COGS): $15,400 (flour, cheese, etc.)

- Labor Costs: $17,600

- Operating Expenses: $19,250

- Total Expenses: $52,250

Calculating the Pizzeria's Gross Profit Margin

First, let's see how profitable the menu is.

( $55,000 Revenue - $15,400 COGS ) / $55,000 Revenue = 0.72 or 72%

A 72% gross margin is fantastic. It means the menu pricing and food cost control are rock-solid. For every dollar in sales, 72 cents is left to cover other costs. If you want to dive deeper, a good restaurant profit margin calculator guide can be a huge help.

Calculating the Pizzeria's Net Profit Margin

Now for the reality check. What’s actually left after every bill is paid?

( $55,000 Revenue - $52,250 Total Expenses ) / $55,000 Revenue = 0.05 or 5%

A 5% net profit margin is solid for an independent restaurant, showing the business is financially healthy and built to last.

Example 2: The Busy Coffee Shop

Next, let's look at a bustling coffee shop with a high-volume, fast-service model.

- Monthly Revenue: $40,000

- Cost of Goods Sold (COGS): $12,000 (coffee, milk, pastries)

- Labor Costs: $14,000

- Operating Expenses: $10,800

- Total Expenses: $36,800

Calculating the Coffee Shop's Gross Profit Margin

Let's see how the coffee and food items are performing.

( $40,000 Revenue - $12,000 COGS ) / $40,000 Revenue = 0.70 or 70%

That 70% gross margin is very healthy, pointing to strong pricing and smart sourcing.

Calculating the Coffee Shop's Net Profit Margin

Finally, let's see what the owner actually takes home.

( $40,000 Revenue - $36,800 Total Expenses ) / $40,000 Revenue = 0.08 or 8%

An 8% net profit margin is brilliant for a small food and beverage business, reflecting a lean operation with well-managed labor and overhead.

Understanding What a Good Profit Margin Looks Like

Once you've run the numbers-maybe with a restaurant profit margin calculator-you’re left with the million-dollar question: "Is this any good?" To make your number meaningful, you have to stack it up against industry benchmarks.

This visual breaks down how revenue becomes gross profit after you subtract the direct cost of what you sell.

It’s a simple formula, but it highlights a fundamental truth: controlling your Cost of Goods Sold (COGS) is the most critical first step toward a healthier bottom line.

Why Margins Vary So Much

Not all restaurants are created equal, and their profit margins prove it. A fine-dining spot and a food truck operate in different financial worlds. Understanding why is key to setting realistic goals.

The main drivers are:

- Service Model: Full-service restaurants require more staff than counter-service spots, leading to higher labor costs.

- Overhead: A downtown location has higher rent than a food truck with no lease.

- Food Costs: A farm-to-table bistro has higher COGS than a pizzeria buying ingredients in bulk.

Because of this, a 3-5% net margin might be a massive win for one business, while another might need to hit 8-10% to feel comfortable.

Benchmarks for Different Restaurant Types

Here’s a breakdown of typical net profit margins for different restaurant models. Use this as a sanity check to see where you stand.

| Restaurant Type | Average Net Profit Margin | Key Influencing Factors |

|---|---|---|

| Full-Service Restaurants | 3-5% | High labor and overhead keep margins tight. Success depends on strong menu engineering and exceptional service. |

| Quick-Service (QSR) | 6-10% | Lower labor needs and high volume create healthier margins. Efficiency is the name of the game. |

| Food Trucks | 6-9% | Drastically lower overhead is a huge advantage, but margins can be hit by event fees, permits, and weather. |

| Bars & Taverns | 10-15% | Alcohol has a very high gross margin. With lower food-related labor, bars can be highly profitable if they manage inventory well. |

Seeing these numbers puts your own performance into context. A pizzeria owner hitting a 5% net margin is doing well, but a bar owner at that same level has a reason to start digging into costs.

The most profitable restaurants aren't always the busiest. They're the ones who deeply understand their business model and manage their unique costs with precision.

Quick-service spots are often the profit darlings of the industry. Top performers can average net margins of 6-10%. Recent data from Square shows that fast-casuals using technology like self-serve kiosks can maintain lean labor margins of 17.4-21.2%.

Spotting and Plugging Hidden Profit Drains

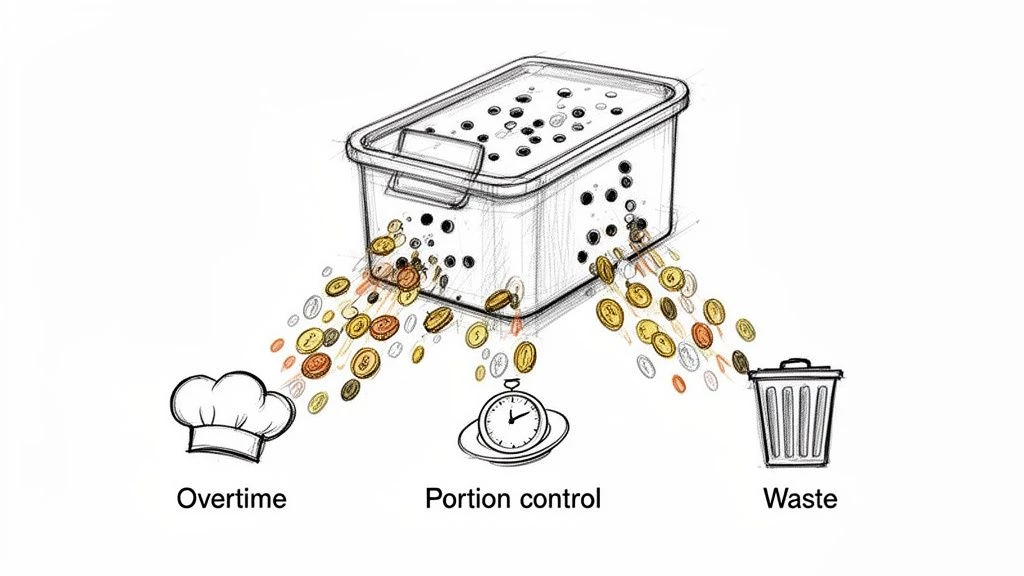

It's the small leaks that sink the ship. The most maddening part of running a restaurant isn't big expenses like rent; it's the silent killers that slowly drain your bank account. A profit margin calculation drags these hidden costs into the light.

Let's get specific and dig into the real problems quietly costing you thousands.

1. The Portion Control Problem

This is the most common profit leak. A little extra cheese, a few more fries-it feels generous, but it devastates your food cost calculations.

- How it plays out: Your burger recipe calls for a 4-ounce patty. During a rush, a cook eyeballs it and makes them closer to 4.5 ounces. That's a 12.5% cost increase on every single burger. Over hundreds of orders, that "tiny" mistake adds up to a massive financial hit.

- The Fix: Take the guesswork out of it. Use tools: portion scoops, pre-weighed protein bags, and specific ladles for sauces. Make consistency the only option.

Your menu prices are based on exact measurements. If your kitchen isn't just as precise, the profit margin on paper will never match what's in your bank account.

2. Inefficient Staffing That Burns Cash

Paying people to lean on a counter during a slow period is like setting cash on fire. Bad scheduling isn't just about having too many people; it's about having the wrong number at the wrong times.

- The common mistake: An owner schedules three servers for a Tuesday lunch because "that's what we've always done." But POS data shows sales tank by 40% after 1:30 PM. For that last hour, you're paying three staff members when you only need one. That's pure payroll waste.

- The Fix: Stop scheduling based on habit. Use your POS data to pinpoint your true peak and off-peak hours for every day, and build your schedule around that reality. Use split shifts or send staff home early when the data shows a predictable dip.

3. Pricing Your Menu Based on Fear

Many owners set prices by looking at the competition or worrying they'll scare customers away. This is a direct path to razor-thin margins. Your pricing must be rooted in your actual costs, not emotions.

- The classic error: A café owner prices her latte at $4.45 because the shop down the street sells them for $4.50. She has no idea her competitor gets a huge volume discount on beans and her own cost is $0.50 higher. She's now pushing a popular item at a nearly non-existent margin.

- The Fix: Use a menu engineering worksheet. Calculate the exact plate cost of every item. Then, price it to hit your target gross profit margin. This data-driven approach ensures every single thing you sell is making you money.

Simple Strategies to Increase Your Profit Margin

Knowing your numbers is the first step. Improving them is where real growth happens. Boosting your bottom line isn't about one drastic change; it’s about making a series of smart, targeted improvements.

Let's focus on three core areas: smart menu engineering, tighter cost control, and driving more sales from customers who already love what you do.

1. Engineer Your Menu for Maximum Profit

Your menu is your single most powerful sales tool. Menu engineering is about designing it to subtly encourage customers to buy your most profitable items.

First, categorize every menu item:

- Stars: High profit, high popularity. These are your winners. Feature them prominently.

- Plowhorses: Low profit, high popularity. Customers love them, but they aren't making you much money. Can you tweak the recipe or pair them with a high-margin side?

- Puzzles: High profit, low popularity. These are hidden gems. Give them a better name, write a better description, or train staff to recommend them.

- Dogs: Low profit, low popularity. Be honest. These items are taking up space. It’s probably time to remove them.

By redesigning your menu to draw the eye to your "Stars," you can naturally guide customers toward more profitable choices.

2. Squeeze Every Dollar from Your Operating Costs

Your daily operations are full of opportunities to trim waste and cut expenses without affecting the guest experience. These small wins compound over time.

- Negotiate with suppliers. Ask about discounts for bulk orders or paying invoices early. Get competing quotes every six months.

- Conduct an energy audit. Train staff to turn off equipment, maintain your HVAC and refrigeration systems, and install low-flow faucets.

- Review software subscriptions. Are you paying for POS features you never use? Look for simpler, more cost-effective tools.

You can find more ideas in our guide on the best restaurant management software for small businesses.

The goal isn't just to cut costs, but to eliminate waste. A dollar saved from a high utility bill is a dollar of pure profit-the easiest money you'll ever make.

3. Drive More Sales from Your Existing Customers (The Ultimate Profit Driver)

This is where the magic happens. It costs 5 to 25 times more to get a new customer than it does to keep an existing one. Loyal customers are the foundation of a profitable business-they visit more often, spend more, and act as your best marketing team.

A simple, effective loyalty program is the most direct way to build this profitable following. But many owners get bogged down by complex systems, plastic cards, and clunky apps. The solution needs to be effortless.

This is exactly why BonusQR exists. It was designed for busy small business owners who need results without the headache. Customers just scan a QR code to join and track rewards. No apps, no cards, no friction. This simplicity means more customers will actually participate, directly encouraging that next profitable visit.

How a Simple Loyalty Program Directly Boosts Your Net Margin

BonusQR isn't a marketing gimmick; it's a powerful lever for your net profit margin. Here’s how:

- Increases Customer Lifetime Value: Giving customers a reason to return turns one-time visitors into regulars. A tiny 5% increase in customer retention can boost profits by 25% to 95%.

- Boosts Average Check Size: Loyalty members genuinely spend more. They feel valued and are more open to adding that dessert or extra drink to reach their next reward.

- Lowers Marketing Costs: Instead of constantly paying for ads to attract new faces, you're investing in people who already love your business. It's a shift from expensive acquisition to cost-effective retention.

The beauty of BonusQR is its simplicity. It delivers all the profit-boosting benefits of a complex loyalty program without adding any complexity to your day. You get a direct line to your best customers, encouraging the repeat business that is essential for a healthy bottom line. And you can get it all set up in minutes.

Still Have Questions? We've Got Answers

After using a restaurant profit margin calculator, it's normal to have questions. Getting these concepts straight is how you turn data into smart decisions.

Here are the answers to a few common questions from owners like you.

How often should I calculate my profit margins?

Get on a consistent schedule.

- Calculate Gross Profit Margin weekly. This is your early warning system. It helps you spot problems with food costs or waste right away.

- Calculate Net Profit Margin monthly. This gives you time to gather all your operating expenses (payroll, rent, utilities) for a complete and accurate look at your overall profitability. This guides your big-picture strategy.

What's the real difference between profit margin and markup?

This is a common point of confusion.

- Markup is the amount you add to an item's cost to get its selling price. If a dish costs $5 and you sell it for $15, your markup is $10.

- Profit Margin is the percentage of the final selling price that is profit. In the same example, your profit margin is ($10 profit / $15 selling price), which is 66.7%.

A simple way to remember: Markup builds the price up from your cost. Profit margin tells you what percentage of the final price you get to keep.

Can a simple loyalty program really help my net profit margin?

Absolutely. A good, easy-to-use loyalty program has a direct and powerful impact on your net profit margin.

First, it's far cheaper to retain an existing customer than acquire a new one. By encouraging repeat visits, a tool like BonusQR helps you cut your marketing spend, a major operating expense.

Second, loyal customers visit more often and spend more when they do. They are your best customers, and a loyalty program gives them a solid reason to choose you over a competitor. This directly boosts total revenue without increasing fixed costs like rent.

When you increase revenue while trimming your marketing budget, you directly increase your net income. That’s the very definition of a healthier net profit margin.