It’s a tough feeling for any small business owner: you realize a familiar face hasn't been around in a while. Reducing customer churn is about plugging the leaks in your business-keeping the loyal customers you’ve worked so hard to win. It means understanding why people leave and giving them compelling, tangible reasons to stick around.

Why Am I Losing Customers and How Much Is It Costing Me?

Ever wonder what happened to that regular who used to come in every Tuesday? Customer churn, the rate at which customers stop doing business with you, is a silent drain on your revenue. For a small business, each lost customer is a relationship that faded and future income that just walked out the door.

This isn't just about a few quiet weeks; it's a huge financial problem. The reality of customer churn is especially harsh in the hospitality and restaurant world. The global retention rate is hovering at a dismal 55%, which means a shocking 45% churn rate that leaves owners scrambling.

For a local coffee shop or salon, a seemingly small 5% monthly churn can compound into a 46% annual loss. That’s almost half your customer base, turning your neighborhood spot into a revolving door of one-time visitors. You can explore more data on these retention benchmarks and see how your industry stacks up.

What causes customer churn?

Customers rarely leave without a reason. The problem is, most of them won't tell you what it was. They just disappear. Getting to the bottom of the common causes is the first real step toward building a retention strategy that actually works.

A few usual suspects are often to blame:

- Poor Customer Service: One bad interaction-like a rushed barista or an unresolved complaint-is often enough to lose someone for good.

- Lack of Perceived Value: If customers don't feel appreciated or see a clear benefit in returning, they'll naturally drift to competitors who offer a better deal or a more engaging experience.

- Inconsistent Experiences: One great visit followed by a mediocre one creates uncertainty. Customers crave reliability more than anything.

The truth is, most churn isn't caused by a single catastrophic event. It's the result of small, overlooked friction points that accumulate over time, making a competitor's offer look a lot more appealing.

Feeling overwhelmed? Don't be. You can start turning things around today by focusing on three core areas. This guide gives you practical steps and simple tools to keep your regulars coming back for more.

We'll even show you how a straightforward, cost-effective loyalty tool like BonusQR can help you tackle these challenges without adding complexity to your day.

Your Quick-Action Plan to Fight Customer Churn

| Strategy Pillar | Why It Matters | Your First Step Today |

|---|---|---|

| 1. Improve the Customer Experience | This is your foundation. A great experience makes customers want to come back, regardless of price or perks. | Map out your customer's first five minutes with your business. Find one small thing you can improve immediately. |

| 2. Build a Simple Loyalty Program | Loyalty programs give customers a tangible, financial reason to choose you over a competitor. They feel recognized and rewarded. | Set up a free trial of a digital loyalty app like BonusQR. Create your first reward-maybe a free coffee or 10% off. |

| 3. Re-engage and Win Back Customers | It's 5-25x cheaper to win back an old customer than to find a new one. A targeted offer can remind them why they liked you. | Identify a few customers who haven't visited in 60 days. Send them a personal "we miss you" email with a special offer. |

This table gives you the big picture, but the real magic is in the details. Let's get started.

How to Measure Your Customer Churn Rate

Before you can fix customer churn, you need to know what you're up against. Think of it like a leaky bucket-you wouldn't try patching it without first knowing how fast the water is getting out. Measuring your customer churn rate gives you a real number you can track and improve.

The good news? You don't need fancy software. The formula is refreshingly simple, but the story it tells is powerful.

The Simple Churn Rate Formula

The calculation for customer churn rate tells you the percentage of customers who stopped doing business with you over a specific timeframe, like a month or a quarter.

Here’s the basic formula:

(Lost Customers ÷ Total Customers at Start of Period) x 100 = Churn Rate %

This little equation reveals a lot. Let's say you started the month with 200 regular customers but lost 10 of them. Your churn rate would be 5%. Keeping an eye on this number helps you catch problems before they spiral. A sudden jump from 5% to 8% is a clear signal that something’s off.

If you’re comfortable with spreadsheets and want to dig deeper, you can even explore an AI-powered churn rate analysis to uncover more detailed insights from your data.

Churn Rate in the Real World

Let's ground this in reality with a few examples:

- A Coffee Shop: Your shop had 400 members in its loyalty program at the beginning of June. By the end of the month, you see that 20 of them haven't stopped by at all. Your calculation is (20 ÷ 400) x 100 = 5% monthly churn.

- A Hair Salon: You kicked off the quarter with 150 clients on the books. Over those three months, 15 of them don't rebook. Your quarterly churn is (15 ÷ 150) x 100 = 10%.

- A Small Retail Store: You're tracking everyone who made a purchase in the last six months. On January 1st, that list had 500 active customers. By July 1st, 75 have fallen off. Your six-month churn rate is (75 ÷ 500) x 100 = 15%.

By calculating this regularly, you move from guessing to knowing. It transforms a vague feeling of "we seem slow" into a concrete metric you can actively work to improve.

Metrics That Complete the Picture

While your churn rate is the star of the show, a couple of related metrics provide the full context:

- Customer Lifetime Value (CLV): This is the total profit you expect from a single customer. Reducing churn is the fastest way to boost your CLV.

- Repeat Purchase Rate: This one’s simple: what percentage of your customers come back for a second purchase? It’s a fantastic early indicator of satisfaction.

For a deeper dive into the numbers, check out our guide on how small business owners can calculate customer churn rate. It’s packed with more examples and templates to get you started.

Creating an Unforgettable Customer Experience

Measuring churn tells you what the problem is, but creating a stellar customer experience is how you actually solve it. This is where you build loyalty from the moment someone walks through your door.

Think about it from your customer's perspective. For a coffee shop, it’s the difference between a rushed transaction and a barista who remembers a regular's name. These small, human touches transform a simple purchase into a memorable interaction. That’s how you start reducing customer churn before it’s even a risk.

The High Cost of a Bad Experience

Poor service isn't just an inconvenience; it's the number one reason customers walk away. We've all been there-long waits, rude staff, unresolved issues. These moments push people straight to your competitors.

The numbers are staggering. Across major markets, bad customer service is responsible for a whopping 67% of all churn. For businesses like restaurants, salons, and coffee shops, this contributes to a massive 45% churn rate, costing the global economy $1.6 trillion every year. If you want to dig deeper into the data, you can read the full analysis on customer churn drivers.

But don't let those figures scare you. See them for what they are: your biggest opportunity. By focusing on service quality, you're directly tackling the main reason customers leave.

Empowering Your Team to Be Problem Solvers

Your frontline staff are the face of your business, and their ability to handle issues on the spot is a superpower. Here's a secret: a customer who has a problem that gets resolved quickly often becomes more loyal than one who never had an issue at all. This is known as the service recovery paradox.

Train your team not just to follow a script, but to listen, empathize, and take ownership.

- Listen Actively: Teach them to truly hear a customer's frustration. A simple "I understand why you're upset" can work wonders.

- Empower with Autonomy: Give your staff the authority to make things right. A barista who can offer a free pastry to fix a botched order, no questions asked, instantly turns a negative into a positive.

- Follow Up: For bigger issues, a quick follow-up shows you genuinely care.

The goal isn't just to solve the problem; it's to make the customer feel seen and respected. When you do that, you're not just saving a single transaction-you're saving a long-term relationship.

Turning Feedback into Your Retention Tool

How do you fix problems you don't even know exist? Most unhappy customers won't complain; they just stop coming back. This is where gathering instant, low-effort feedback becomes a game-changer for reducing customer churn.

Imagine a customer gets a lukewarm coffee. They're in a rush and don't want to make a scene. But on their way out, they see a simple QR code on the table: "How did we do today?" They scan it, tap a frowny face, and leave a quick note.

This is where a simple tool like BonusQR is invaluable. The system can instantly alert a manager to the negative feedback. You now have a chance to find that customer before they leave, apologize, and remake their drink.

You’ve just performed real-time service recovery, turning a potential lost customer into a moment of exceptional care.

Building a Loyalty Program That People Actually Use

A great experience makes people happy for a day. A great loyalty program gives them a reason to come back for a lifetime.

Forget those flimsy paper punch cards that get lost or complicated points systems that feel impossible to figure out. The goal is a program so simple and rewarding that choosing you becomes a no-brainer.

The secret to reducing customer churn with a loyalty program is to kill the friction. Your customers shouldn't have to download yet another app or remember a password. A simple QR code-based system shines here, making it effortless for both your customers and your staff.

A customer scans a QR code with their phone, and boom-their digital stamp card pops up. It’s instant, easy, and doesn't require your team to juggle anything at the register.

Design Rewards That Actually Motivate

The rewards you offer are the heart of your program. A tiny discount can actually do more harm than good, making your business seem cheap rather than generous. The key is to offer rewards that feel genuinely special and valuable.

Put yourself in your customers' shoes. What would they really want? For a restaurant, a free appetizer feels way more generous than 10% off an entree. A salon could offer a complimentary deep conditioning treatment-a high-value, low-cost add-on-instead of a minor discount.

The best rewards make your customers feel like insiders. They aren't just getting a deal; they're earning an exclusive perk that says, "We see you, and we appreciate you."

This simple shift-from a discount to an experience-can dramatically boost participation.

Here’s what that looks like in the real world:

This screenshot from BonusQR shows just how clean and straightforward a digital stamp card can be. It's visual, intuitive, and the goal is crystal clear. The customer sees their progress and feels that little nudge to come back.

Effective vs Ineffective Loyalty Rewards

| Reward Type | Why It Works (Effective) | Why It Fails (Ineffective) |

|---|---|---|

| Experiential Rewards | A free appetizer, a complimentary product upgrade, or a bonus service. Feels like a genuine treat and adds value. | A tiny 5% discount. Feels transactional and cheap, and doesn't create an emotional connection. |

| Your Best-Sellers | Offering your most popular item for free (e.g., "Buy 9 coffees, get the 10th free"). It's a reward you know they already love. | A discount on a slow-moving item. Customers see this as you trying to offload old inventory. |

| Exclusive Perks | Early access to a new menu, a members-only event, or a special "insider" price. Creates a sense of community. | A generic, impersonal coupon sent to everyone. It doesn't feel special and gets lost in the noise. |

| Simple & Attainable | A reward that can be earned in a reasonable number of visits. Quick wins build momentum and keep customers engaged. | A reward that requires an unrealistic amount of spending. Customers lose motivation and abandon the program. |

Ultimately, a good reward feels like a thank you, not just a marketing tactic.

Tap into the Psychology of Progress

Ever wonder why seeing a digital stamp card fill up is so motivating? It’s all thanks to the "endowed progress effect." When people feel they’ve already made progress toward a goal, they are significantly more likely to see it through.

A digital loyalty card is the perfect tool for this. Every scan and every new stamp delivers a small hit of satisfaction. They can literally see themselves getting closer to the prize.

Just think about these two scenarios:

- Restaurant: A customer sees they are only two stamps away from a free pizza. The next time they’re deciding on dinner, that proximity to a reward makes your restaurant a much more compelling choice.

- Salon: A client sees they are halfway to a complimentary treatment, encouraging them to pre-book their next appointment.

For a deeper dive, learn more about how to create a loyalty program customers will actually use and put these powerful principles into practice.

Using Customer Data to Win Back At-Risk Customers

The data you collect from your loyalty program isn't just for tracking stamps; it's a goldmine for reducing customer churn. It tells you who your regulars are and-most importantly-who might be about to leave you for good.

When you pay attention to this information, you can stop guessing and start acting with precision.

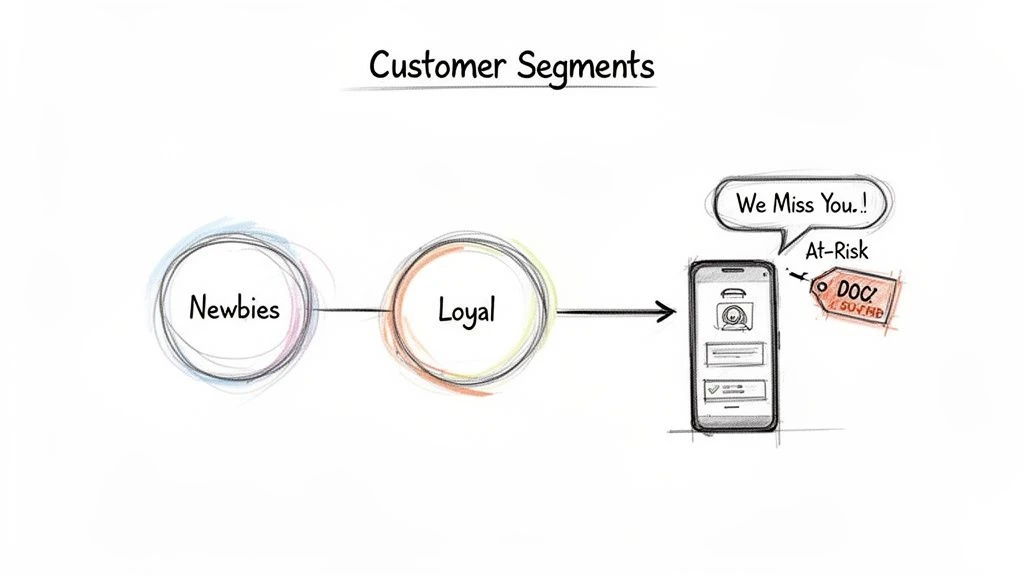

This process is often called 'customer segmentation.' It might sound complicated, but it's actually pretty straightforward. You're just grouping customers into a few basic categories.

Identify Your Key Customer Groups

Think of your entire customer base in three simple buckets. Each group needs a slightly different touch.

- Newbies: First-time or very recent visitors. Your one goal is to make an amazing impression and lock in that crucial second visit.

- Loyal Regulars: Your VIPs. They visit often and know your staff by name. The goal is to keep them feeling appreciated.

- At-Risk Customers: People who used to be regulars but haven't stopped by in a while-say, the last 60 or 90 days.

A simple tool like BonusQR makes spotting this last group effortless. It automatically tracks visit dates, so you can see at a glance who’s slipping away without having to dig through old records.

Launch a "We Miss You" Campaign That Works

Once you’ve identified your at-risk customers, it's time to reach out with a personal message. This isn't a generic marketing blast. It's a targeted, friendly nudge designed to remind them why they liked you in the first place.

The financial incentive is huge. Slashing churn by just 5% can boost profits by a staggering 25-95%. This is especially critical when you consider that returning customers spend 67% more than new ones.

Winning back a past customer is one of the most cost-effective growth strategies out there. You can discover more insights about the profitability of retention and see just how powerful it is.

A win-back campaign is your last, best chance to reignite a fading relationship. It shows customers you noticed they were gone and, more importantly, that you want them back.

Here are a couple of simple, actionable templates you can adapt for email or SMS.

Actionable Win-Back Campaign Templates

Keep your message short, personal, and focused on a compelling offer.

Example 1: For a Hair Salon (SMS) "Hi [Customer Name]! We've missed seeing you at Style & Grace Salon. To welcome you back, we're offering you a complimentary deep conditioning treatment with your next haircut. Book this week to claim your treat! [Link to booking page]"

This works because it’s personal, offers a high-value perk, and creates urgency.

Example 2: For a Coffee Shop (Email) Subject: Is It Something We Said? A Treat Is Waiting For You!

"Hi [Customer Name],

It's been a little while since your last visit to The Daily Grind, and we've missed you!

As a little incentive to come say hello, we’ve added a FREE pastry of your choice to your loyalty account. Just scan your QR code on your next visit to redeem it.

We can't wait to see you again!

The Team at The Daily Grind"

This one feels warm and friendly and presents the offer as a gift that's already waiting for them. By using data from your loyalty system, you can turn a potential loss into a profitable return visit.

A Few Common Questions About Customer Churn

Even with a great plan for reducing customer churn, you probably still have some questions. Let's tackle the most common ones we hear from small business owners like you.

How Often Should I Calculate My Customer Churn Rate?

For most small businesses-cafes, salons, local shops-calculating your churn rate monthly is the sweet spot. It's frequent enough to catch a negative trend before it spirals, but not so often that it feels like a chore.

Monthly tracking gives you a fast read on what's working. Say you launch a new loyalty program with BonusQR in May. Your June churn rate gives you a clear, almost immediate signal on its impact. Waiting a full quarter is the absolute longest you should go.

What Is a Good Churn Rate for a Small Business?

This is the million-dollar question, but the honest answer is... it depends. There's no single magic number. A software company might aim for under 5% annually, while a restaurant might see that much churn every month and still be thriving.

Instead of getting hung up on some universal benchmark, focus on your own progress.

A 'good' churn rate for your business is one that is consistently getting smaller over time. It's the ultimate proof that what you're doing is working.

If your churn rate is 8% this month, your goal should be to nudge it down to 7.5% next month. That steady downward trend is the real sign of a healthy business.

Can a Loyalty Program Really Make a Big Difference?

Absolutely. But there’s one huge catch: it has to be dead simple to use and offer rewards people actually want. When done right, a loyalty program is one of the most powerful tools in your arsenal. It gives customers a tangible, compelling reason to walk past a competitor and straight to your door.

Modern, easy-to-use digital programs like BonusQR are especially effective. When a customer sees their digital stamp card filling up, it triggers a little psychological itch-it becomes much harder for them to break that streak and go somewhere else. Since retained customers spend more, a loyalty program is a direct, affordable, and high-impact investment in your bottom line.

For a deeper dive, this article outlines more proven strategies to boost retention and reduce customer churn with additional actionable tips.

Is My Business Too Small to Worry About Analytics?

Nope. In fact, it’s arguably more important for you than for some giant corporation. Big companies have huge marketing budgets to simply buy new customers to replace the ones they lose. For a small business, every single customer is precious.

And "analytics" doesn't have to be some scary, complicated dashboard. It can start as a simple spreadsheet where you track new versus lost customers each month.

This is another spot where a simple digital loyalty app can be a game-changer. It automates most of the basic tracking for you, showing you who your regulars are and-just as critically-who has stopped coming around. Don't let the word "analytics" intimidate you. At its core, it’s just about paying close attention to who's staying and who's leaving. And that kind of focus is absolutely essential for building a business that lasts.