Are you putting in the hours, seeing customers come and go, but feeling like your business is stuck on a treadmill? You're busy, but you're not growing. If this sounds familiar, you're likely facing a hidden problem that quietly drains your profits and stalls your growth: customer churn.

This guide is for you, the small business owner who needs a clear, no-nonsense way to understand why customers are leaving and what you can do about it. We’ll show you how to calculate your customer churn rate using tools you already have, turning a confusing metric into your most powerful tool for building a more stable, profitable business.

The Hidden Metric Costing Your Business Money

Customer churn is simply the rate at which your customers stop doing business with you. Think of your business as a bucket. You can spend all your time and money pouring new customers in the top, but if your loyal, existing customers are constantly slipping out through holes in the bottom, you’ll never actually fill it. You're just running in place.

Why This Silent Leak Matters

For a local coffee shop, churn isn't one big event. It's the regular who used to visit three times a week but now only comes once a month. For a salon, it's the client who hasn't rebooked in ninety days. You might not notice one or two people fading away, but the cumulative effect is a massive drag on your growth.

The financial sting is even sharper. It costs anywhere from 5 to 25 times more to attract a new customer than to keep an existing one. This statistic alone transforms customer loyalty from a "nice-to-have" into a core survival strategy for any small business.

Churn isn't just a metric on a spreadsheet; it's a direct reflection of your customer experience. A high churn rate is a flashing red light, signaling that something about your service, product, or overall value isn't hitting the mark.

The Silent Business Killer: What Churn Really Costs You

Ignoring churn is an active drain on your resources. Let’s compare a business with a high churn rate to one with a low churn rate to see the real-world impact.

| Impact Area | High Churn Scenario (e.g., 10% monthly) | Low Churn Scenario (e.g., 2% monthly) |

|---|---|---|

| Revenue Stream | Unpredictable and unstable. Constantly chasing new sales to fill the gap. | Stable and predictable. Revenue grows as loyal customers spend more over time. |

| Marketing Budget | Sky-high. Most of the budget is spent on expensive acquisition campaigns. | Efficient. Marketing focuses on low-cost retention and word-of-mouth referrals. |

| Team Morale | Stressful. Staff are always dealing with new, unfamiliar customers. | Positive. Team builds genuine relationships with happy, returning regulars. |

| Business Growth | Stagnant or declining. The "leaky bucket" prevents any real forward momentum. | Sustainable and organic. The business grows on a solid foundation of loyalty. |

| Customer Feedback | Limited. Lost customers rarely explain why they left, leaving you in the dark. | Rich and actionable. Loyal customers provide valuable insights for improvement. |

High churn creates a vicious cycle of instability that affects everything from your marketing budget to your team's day-to-day happiness.

When you let churn go unchecked, you're not just losing customers-you're losing predictable income, your most powerful marketing tool (word-of-mouth), and priceless feedback. Taking the time to understand the real cost of customer retention is the first, most crucial step toward plugging that leak.

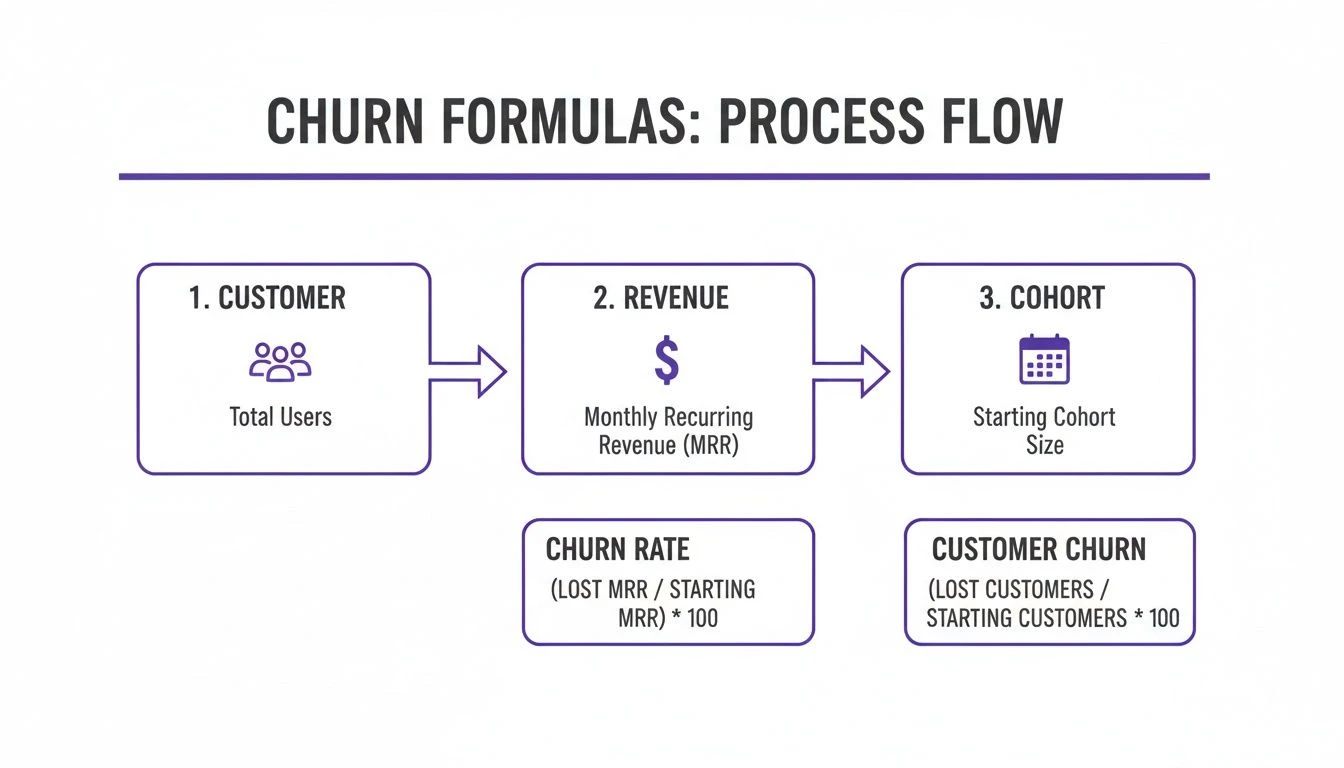

Essential Formulas for Calculating Customer Churn

Forget intimidating spreadsheets. Understanding your customer churn rate is one of the most empowering things you can do for your business, and it’s something you can start today. Let’s walk through the three most vital formulas every small business owner should know.

Each formula tells a slightly different part of your customer story, giving you a complete picture of your business's health.

The Basic Customer Churn Rate

This is your starting point. It answers the most fundamental question: How many of my customers are leaving?

This formula gives you a clear percentage of the customers who walked away during a specific period (like a month or a quarter). It's the quickest way to get a pulse check on customer loyalty.

The formula is beautifully simple:

(Customers Lost ÷ Total Customers at Start of Period) x 100 = Customer Churn Rate %

Let's use a real-world example. Imagine you run a local salon. You started April with 200 clients. By the end of the month, you realize 10 of them haven't been back or rebooked.

Your calculation: (10 ÷ 200) x 100 = 5% monthly churn rate. Just like that, you have a solid benchmark. This number is your foundation, but to get the full picture, you'll also want to see our guide on how to calculate customer retention rate, which covers the other side of the coin.

The Revenue Churn Rate

Now we dig deeper. The basic formula treats every lost customer as equal, but we know that's not the reality. Losing a customer who bought one coffee is a different problem than losing a daily regular.

Revenue churn answers a more painful question: How much money am I losing? This calculation reveals the true financial sting of your churn.

Key Insight: A low customer churn rate can easily mask a dangerously high revenue churn rate. If the few customers you lose happen to be your biggest spenders, your business is in more trouble than the basic number suggests.

Let's go back to your salon. Of those 10 clients you lost, five were occasional haircut clients spending about $50 a month, while the other five were high-value color clients averaging $200 a month.

- Customer Churn: 10 people

- Revenue Churn: $1,250 in monthly revenue

Suddenly, the picture is much clearer. 50% of your churned customers were responsible for 80% of the lost revenue. That’s a powerful insight that tells you exactly where to focus your retention efforts.

The Cohort Churn Rate

This is your secret weapon for strategic thinking. A "cohort" is a group of customers who all started with your business around the same time (e.g., all new customers from January).

Cohort analysis lets you track these groups to answer the most important question of all: Are my retention efforts actually working?

For instance, maybe you launched a new loyalty program with BonusQR in March. By tracking the "March Cohort," you can see if they have a lower churn rate in April and May compared to the "February Cohort" who signed up before the program existed. This is how you prove, with real data, that your new strategies are paying off.

Of course, tracking customers is one part of the financial puzzle. Another critical metric is understanding cash burn rate, which is essential for managing your long-term health.

How to Calculate Churn With Tools You Already Use

Let's put this theory into practice. One of the biggest myths holding small business owners back is the idea that you need expensive, complex software to figure out your churn rate. The reality? You already have everything you need.

The data is likely sitting in your Point of Sale (POS) system, your appointment book, or a simple loyalty app like BonusQR. You don’t need to be a data scientist. You just need to know where to look.

Finding Your Numbers: A Real-World Example

Let's walk through this with a real-life scenario. Meet Maria, owner of ‘Maria’s Coffee Shop’. She wants to calculate her customer churn rate for July.

Here’s how she finds her numbers using her simple loyalty program:

- Customers at the Start: Maria checks her loyalty dashboard for all customers who made a purchase in June. This gives her 500 active customers on July 1st.

- Customers at the End: She runs the same report for July and sees she finished the month with 520 active customers.

- New Customers Acquired: Her system shows that 45 brand-new customers signed up and made their first purchase in July.

With just these three numbers, Maria is ready to calculate her churn.

Your Simple Churn Calculation Spreadsheet

Now, let's plug Maria’s numbers into a simple formula.

First, we need to find out how many customers were lost. The formula is:

Customers Lost = (Customers at Start + New Customers) - Customers at End

For Maria: (500 + 45) - 520 = 25 Customers Lost

Now she can use the main churn rate formula: (Customers Lost ÷ Customers at Start) x 100.

(25 Lost Customers ÷ 500 Starting Customers) x 100 = 5% Monthly Churn Rate

A 5% monthly churn might not sound like an emergency, but it’s a silent killer. A 5% churn rate each month can wipe out nearly 46% of your customer base over a single year. When you hear that U.S. firms lose a staggering $136.8 billion annually to avoidable churn, you realize how critical tracking this number is.

To get started right away, make a copy of our free Google Sheets Churn Calculation Template. Just plug in your numbers and let the sheet do the work.

Remember, the goal isn't just to find a number. It's to create a benchmark you can improve on. The tools you use are a huge part of this, and our guide on choosing your first customer loyalty software can help.

Common Mistakes That Can Sabotage Your Churn Calculation

Getting a number is easy. Getting the right number is what matters. A skewed churn rate can give you a false sense of security while your most valuable customers are quietly slipping away. Here are the most common traps to avoid.

The biggest mistake? Masking churn with new customer acquisition. Say you gained 50 new customers last month but lost 40 existing ones. On paper, you might just see a net gain of 10 customers and think things are going well. That's a dangerous illusion. In reality, you have a 40-customer leak that needs immediate attention. You must separate acquisition from retention to see the true health of your business.

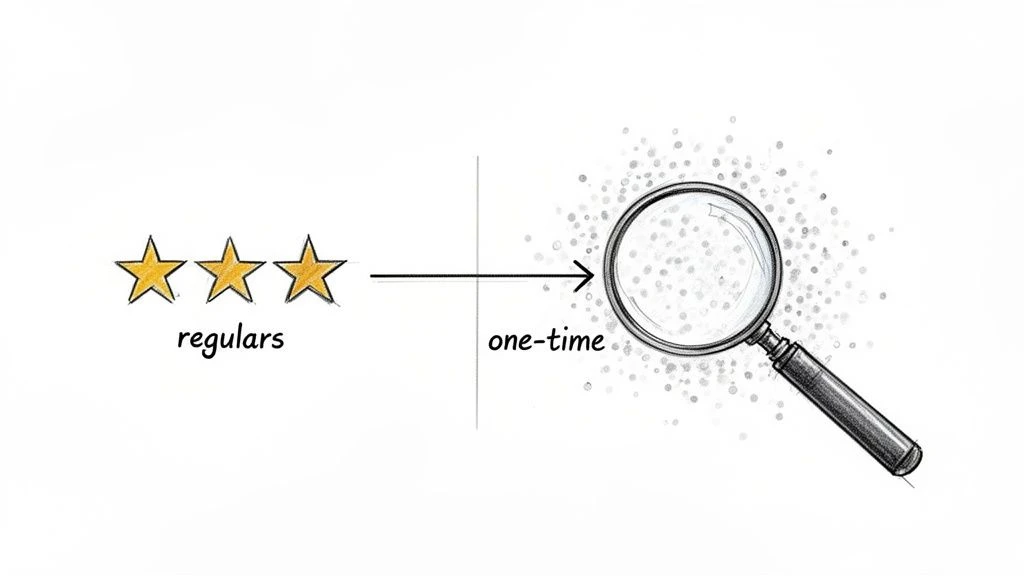

Treating All Customers the Same

Another huge oversight is lumping all your customers together. The impact of losing a daily regular is worlds apart from losing a one-time tourist. If you don't segment, your churn rate will tell you how many people are leaving, but not who-and the "who" is everything.

This is where a simple tool like BonusQR is a game-changer. It automatically tracks visit frequency, so you can instantly see if you're losing:

- Your VIPs: The loyal regulars who are the lifeblood of your business.

- The Casuals: Customers who visit once or twice a month.

- The One-Timers: People who made a single purchase and vanished.

Losing a VIP hurts your bottom line far more than losing a one-timer. By spotting this, you can focus your efforts on keeping the people who pay the bills.

A flat 5% churn rate might seem small, but if that 5% is made up of your biggest spenders, you’ve got a five-alarm fire on your hands.

Forgetting the "Why" Behind the "What"

Your churn rate is a compass, not the destination. The number tells you what's happening, but it doesn't tell you why. Did you change your prices? Is there a new competitor down the street? Did your customer service slip?

To get these answers, you have to look beyond the spreadsheet. Talk to your front-line staff-they hear everything. Read your online reviews. Most importantly, talk to your customers. The context behind the data is where you'll find the insights that lead to real improvement. This is a core part of mastering customer retention metrics.

Turning Your Churn Numbers Into Action

Calculating your churn rate is the first step. Now you can take that number and change it. This is where you move from defense to offense. You don’t need a huge marketing budget or a team of data analysts. For most small businesses, the single most powerful move is implementing a simple, modern loyalty program.

From Data Point to Delighted Customer

A tool like BonusQR turns your churn calculation into an action plan. It helps you see who is drifting away and gives you the tools to bring them back before they're gone for good.

Imagine you notice a customer who used to visit weekly hasn't been around in a month. Instead of just hoping they return, you can proactively send a "We miss you!" offer straight to their phone-like a free coffee or 10% off. This small gesture can be incredibly powerful in reminding them why they chose you in the first place.

You already did the hard work of earning a customer's trust once. Your churn number is a call to action to protect that investment.

This proactive approach is what modern customer retention is all about. Once you know your churn rate, the next step is putting proven strategies to improve retention and lower churn rate into motion.

The Easiest Way to Fight Churn: Reward Loyalty

Fighting churn isn't just about damage control; it's about celebrating your best customers. Your regulars are the foundation of your business, and a great loyalty program makes them feel seen and appreciated. This is how you turn a casual visitor into a passionate advocate.

With a simple, cost-effective tool like BonusQR, you can:

- Reward Your VIPs: Surprise your most frequent customers with exclusive perks.

- Create a Seamless Experience: Let customers earn and redeem rewards with a quick QR code scan-no friction.

- Build a Real Connection: Use the program to share updates and special events, making customers feel like insiders.

This is how you build unbreakable loyalty and turn your churn rate around. Ready for more ideas? Check out our guide on 10 actionable customer retention strategies.

Common Questions About Customer Churn

You've calculated your churn rate. Now what? Let's tackle the most common questions we hear from small business owners.

What’s a Good Customer Churn Rate for a Small Business?

While it varies by industry, a great goal for most local businesses-like cafes, salons, or retail shops-is a monthly churn rate below 5%. The most important thing is to establish your own baseline and work to improve it month after month. The real win is seeing your number consistently drop.

How Often Should I Be Calculating This?

Monthly is the sweet spot. It's frequent enough to catch problems early without getting bogged down in daily fluctuations. We also recommend a quarterly review to see the long-term trends and measure the success of your retention strategies.

Do I Really Need Expensive Software to Figure This Out?

Absolutely not. You don’t need a complicated CRM system to understand churn. Your Point of Sale (POS) system, booking software, or a simple loyalty app like BonusQR has all the customer data you need. A simple spreadsheet is more than enough to organize this information and start finding answers.

Understanding churn is the first step. Taking action is what creates growth. With BonusQR, you can launch a simple, powerful, and affordable loyalty program in minutes to give your best customers a reason to stay and your business the stability it deserves.